Mauritius, the heart of the Indian Ocean, known for an unforgettable holiday has become in recent years an investment centre for many foreigners worldwide. The Mauritian government has therefore developed the Property Development Scheme, which is a new scheme since May 2015 and replaces the IRS and RES law with the difference of no longer having restrictions on the maximum area of the land.

The PDS program takes shape when the investor acquires a set of land with services such as a common sports ground, a spa and a guard service for the security of the enclosure. In addition, investors will be eligible for several benefits such as:

- 0% property tax,

- 0% residential tax,

- No taxes on wealth,

- No taxes on inheritance tax,

- Fixed tax rate at only 15%,

- No taxes on capital gains, among others.

Thanks to this program, the investment cost in Mauritius is lower compared to other countries like France, the United Kingdom or South Africa. What is even more attractive for a foreign investor is to get a residence permit if your investment exceeds $ 500,000. Thus, he can be domiciled fiscally on the Mauritian territory with a minimum of 183 days a year with his / her companion and her children under 24 years as long as it is owner of the good.

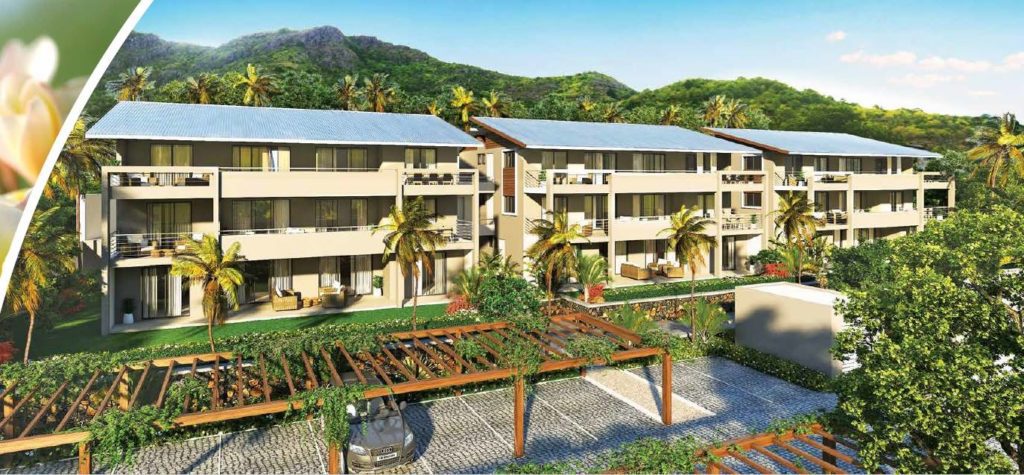

Mauritius also offers foreigners a stable political situation, a democratic political system and a climate. In addition to the tax benefits, Mauritius is the ideal place to invest thanks to its unique living environment, with sunshine almost all year round and its tropical climate. As more than a million tourists visit the island annually and with a growing economy, investors have enough to find a good PDS. The National Assembly goes even further in December 2016 by voting for the Non-Citizens Property Restriction, which allows a foreigner to buy an apartment in Mauritius. However, the apartments or apartment must be located in a condominium of at least 2 floors (R + 2) with the prior approval of the Board of Investment (BOI). To be eligible for this law, the buyer must pay 6 million rupees (about € 155,000) or more to buy an apartment.

Of course, the authorities see this law as a good way to sell unsold apartments locally and attract foreign investment to the island while offering more choices for real estate. Today, the numbers continue to climb with 121 real estate projects that have emerged since the PDS program, 2000 residences were sold on the island with 0% property taxes. Foreign investors can now have prestige real estate while boosting the Mauritian economy and creating jobs in the construction sector. Moreover, with over a million tourists annually on the island, business is constantly changing.

Do you want to invest in real estate in Mauritius? Fill out our form, we will contact you as soon as possible

[contact-form-7 id=”6331″ title=”Formulaire de contact EN”]