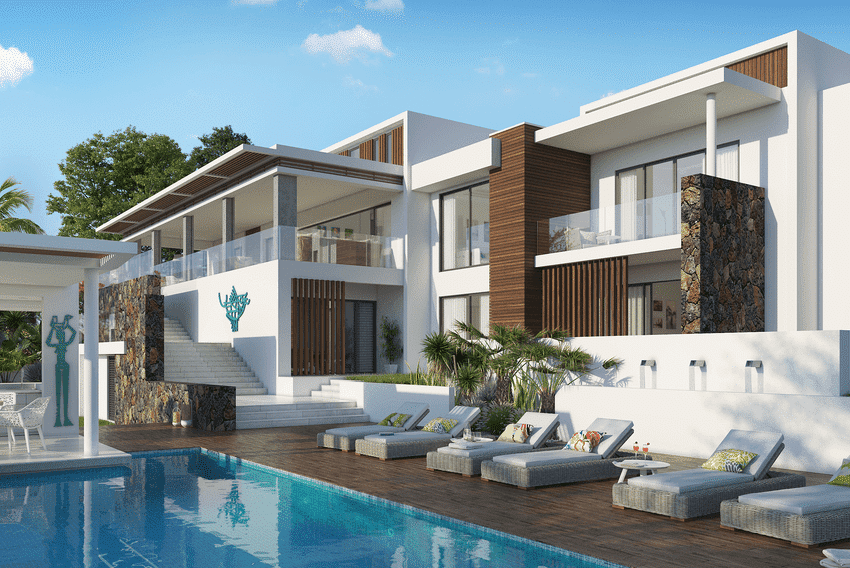

Mauritius enjoys an excellent international reputation for its parliamentary democracy, sustained economic growth over more than three decades, independence of its judicial system and media, and its remarkable political stability. Having become a true reference in terms of stability for the business climate, Mauritius is today a reliable and attractive investment platform for all foreigners. A very large number of investors, mainly French, are thinking of acquiring a property in Mauritius. Young entrepreneurs, retired couples and simple lovers of a lush nature continue to settle on a territory, accessible under certain conditions.

Acquire real estate in Mauritius

For more than fifteen years, the Mauritian state has allowed foreigners to buy a villa in Mauritius. Mauritian legislation is even constantly evolving, further easing the acquisition of real estate on the territory.

In 2015, the Mauritian government replaced the IRS and RES schemes with the Property Development Scheme (PDS). It is an innovative investment concept that aims to facilitate the purchase of luxury Mauritius by a non-citizen. The scheme highlights the social dimension and communal characteristics of residential units built on Mauritian territory.

The PDS (Property Development Scheme) mainly concerns luxury residences built on Mauritius. Unlike the old IRS and RES models, this system is intended not only for foreign nationals, but also for Mauritian citizens. For Mauritians, the PDS does not require a minimum amount of investment. On the other hand, the purchase of a high-end residence as part of a PDS project by a foreigner makes him eligible for a residence permit, provided he invests a minimum of $500,000.

Note that the Mauritian government still allows investment in property under IRS or RES schemes available for sale or resale in the territory.

Terms of purchase under PDS

The PDS (Property Development Scheme) is reserved for:

- An individual (physical), a Mauritian citizen or not.

- A foundation under the Foundation Act.

- A company incorporated and registered under the Companies Act.

- A trust (trustee) whose trusteeship services are provided by a qualified trustee.

- A company whose articles have been filed with the Registrar of Companies.

- Limited partnership under the Limited Partnerships Act.

The contract of Sale in State Future of Completion (VEFA)

Often preceded by a reservation contract in which are mentioned the date of signature of the definitive contract VEFA, the modalities of recovery of the security deposit by the purchaser in case of non-The VEFA contract is drawn up under the same provisions of French law for the protection of purchasers.

According to Article 1601-30 of the Mauritian Civil Code, payments or deposits for the purchase of apartment in Mauritius, must be made as follows:

- 35% of the price at the completion of the

- 70% to the realization of the main work

- 95% at the completion of the works

According to the article of the Mauritian Civil Code, the buyer may be subject to the payment of a security deposit at the time of the signature of the preliminary reservation contract. However, this amount must not exceed 25% of the estimated selling price for a period of execution of the works of a maximum duration of one year. A limit of 2% is required for a period of completion of the sale between 1 and 2 years. For work exceeding 2 years, no deposit may be required.

Generally, this security deposit is paid to a special account opened in the notary’s account or to a special account opened in the name of the reservist in an authorised bank. The money remains unavailable until the final contract of sale is concluded and can be returned to the buyer in the event of non-compliance with the VEFA contract.

Guarantees for real estate investment in Mauritius

To ensure the protection of foreign buyers, the Mauritian government offers several guarantees in terms of the acquisition of real estate on its territory.

-

The guarantee of completion

To ensure its reliability, the real estate developer usually provides a completion guarantee to the buyer. The State also obliges it to provide such assurance. Also, the signing of the deed of sale of the real estate takes place only when the notary has the guarantee of completion that protects the buyer against the bankruptcy of the developer in the course of realisation of the real estate project, to complete the building.

-

The perfect completion warranty (1 year) for the PDS

This warranty obliges the promoter to carry out all necessary repairs in case of non-compliance or hidden defects, observed during the year following the delivery of the keys.

-

The biennial guarantee (2 years)

This warranty obliges the promoter to carry out the repair or replacement work, over a minimum period of 2 years, after receipt, concerning all equipment elements that appear to be malfunctioning.

-

The 10-year guarantee (10 years)

This warranty requires the promoter to repair damage that occurs for 10 years after receipt. It usually involves damage that compromises the building’s strength or makes the building unusable. The 10-year guarantee may be extended to components of equipment which are inseparable from the structure.

For further information on buying a Mauritian house by a foreigner, please visit the Board of Investment website.